Hot July leads to sales heating up at UK Garden Centres

13 August 2025

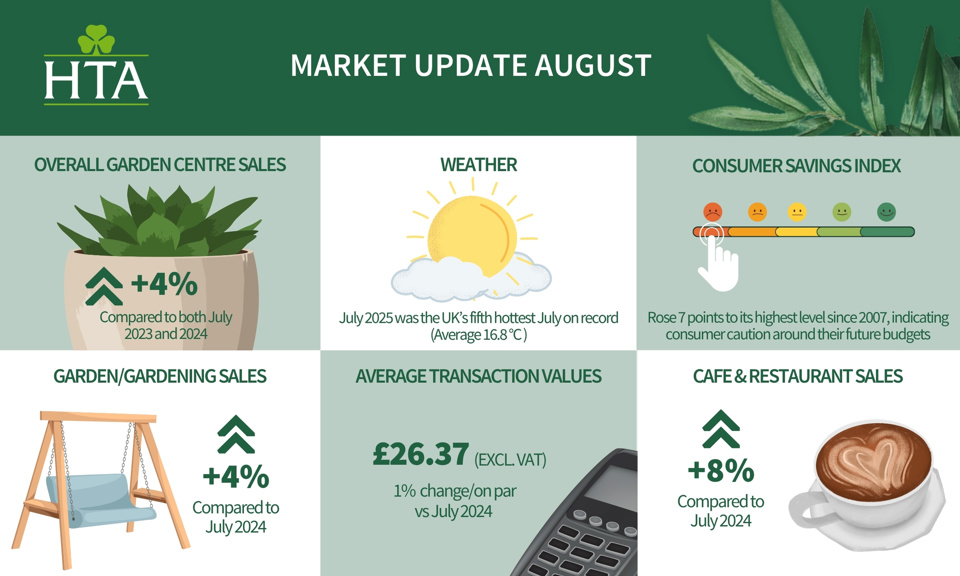

July 2025 was officially the UK’s fifth hottest July on record, with temperatures averaging 16.8°C. As the weather warmed across the country, so too did sales at UK Garden Centres. Latest data from the Horticultural Trades Association (HTA) August Market Update reveals steady growth, with overall revenue up +4% compared to July 2024 and July 2023.

Total transactions for July reached a three-year high, with transactions up +4% from the same period last year. However, the average spend remained steady at £26.37 (excluding VAT), indicating increased footfall rather than higher individual spending.

Gardening product sales remained largely stable, with revenue increasing by +4% compared to July 2024. While garden furniture was the main driver of growth, soaring by +42% from a relatively weaker July 2024, outdoor plant sales struggled due to dry conditions and water restrictions in parts of the UK.

An overall steady July means garden centre year-to-date performance remains strong, with total revenues +10% ahead of last year and 2023. Similar performance in the coming months will be required to maintain the current lead over previous years, with the results of HTA’s Q2 2025 Business Barometer also highlighting how higher operating costs are squeezing profits.

The data, which covers the period up to the end of June, captures sentiment and performance across all HTA and Association of Professional Landscapers (APL) members, including retailers, growers, landscapers, and manufacturers. It reveals that members performed broadly in line with expectations against their budgets. On average, members were only -0.1% behind sales budget and -0.5% behind profit budget, with two-thirds (65%) of respondents meeting or exceeding their profit expectations.

The HTA’s modelling shows that with rising business costs, not accounting for any new provisions needing to be made to cover Inheritance Tax liabilities, an example £2m turnover garden centre would need to see an 11% increase in sales to maintain operating profit margins. Most impacted are the APL members, who face particularly challenging conditions, averaging -7% behind budgeted sales at the end of Q2 2025, as consumers restricted spending on high-value projects.

Fran Barnes, Chief Executive of the HTA, commented:

“July continued to be an encouraging month for our sector, the weather has helped garden centres build on strong spring sales, with particular growth in sales of garden furniture.

“Non-gardening departments also continued their strong momentum throughout 2025 with indoor living and homewares posting the most substantial gains. Catering sales also grew, with garden centre cafes and restaurants displaying strong growth year-on-year. Our Q2 Business Barometer also shows that retailers with catering were outperforming their expected profit at the end of Q2 by a larger margin than retailers without catering.

“Other insights from the Q2 Business Barometer reveal short-term and medium-term business outlooks for retailers, growers, manufacturers, and suppliers were broadly level with Q1 - after the sector somewhat recovered from the end of 2024; but remain low in historic terms.

“On a more optimistic note, long-term business outlooks rose considerably for a second consecutive quarter to their highest level since Q1 2024, despite the Autumn Budget changes coming into effect and the continued uncertainty surrounding the global economy. The strong retail sales across spring 2025 will have offset some of these cost pressures and helped contribute to the positive outlook.

“In the meantime, we know that the prolonged dry and hot weather will bring some challenges, particularly to businesses in drought areas and for our members operating in areas with temporary use bans (TUBs) in place. We continue to monitor the impact of these conditions and are actively engaged in regional water strategies as well as attending the Environment Agency’s National Drought Group. We also have more advice and guidance on water resilience available on our website hta.org.uk/water.”

Consumer confidence dropped slightly by 1 point to -19 in July, remaining broadly stable with recent months. A 7-point increase in the savings index indicates that consumers believe their spending power will constrict in the coming months.

HTA members can access further insights in this month’s Market Update and Q2 Business Barometer on our website.