HTA Market Update: Strong spring sustains a steady summer

17 September 2025

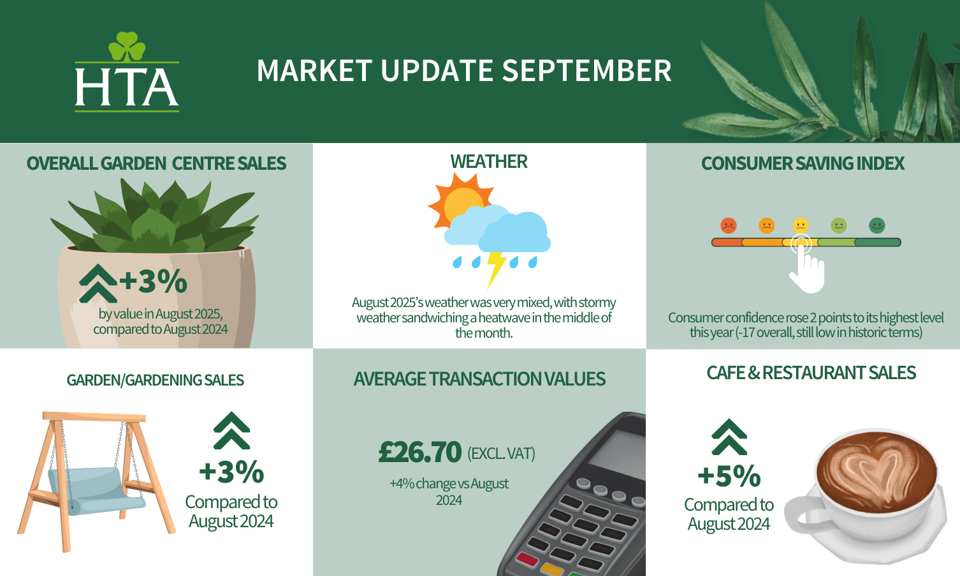

Garden centres maintained steady sales in August 2025, with overall turnover up 3% on August 2024 and 12% on August 2023, according to the Horticultural Trades Association (HTA) September Market Update. Following a strong spring, summer sales growth has moderated slightly, but the retail side of the sector continues to maintain a healthy year-to-date lead.

Fran Barnes, Chief Executive of the HTA, said:

“August’s results show that garden centres are still holding strong despite challenging conditions. Overall sales were up 3% compared to last year, with gardening sales matching this growth and rising 13% from 2023. Bulbs performed exceptionally well, growing +15%, and garden furniture sales increased +13%.

“Much of the overall sales growth is inflation-driven. Total transactions were level with those in August last year, and consumer purchasing volumes remained broadly stable. However, the average spend rose by +4% in stores and +3% in cafés, reflecting higher prices rather than larger baskets.

“The month’s weather illustrated the extremes our sector faces. England experienced a heatwave followed by storms, resulting in almost 1°C hotter temperatures and half the average rainfall compared to August 2024. Scotland, by contrast, was the wettest region of the UK and saw much lower average temperatures, having been most heavily affected by Storm Floris at the start of the month. Groundwater levels and reservoirs remain worryingly low, and although no new temporary use bans have been introduced, Yorkshire Water is seeking further drought permits. This highlights why water resilience remains a top priority for our sector.

“UK consumer confidence recovered by +2 points to -17 in August, its highest level this year, following the Bank of England’s cut to interest rates. Confidence, however, remains historically low amid global trade uncertainty and anticipation of Autumn Budget tax changes. The HTA will submit its budget asks to the Chancellor ahead of 26 November. Against a backdrop of rising business costs, we’ll be calling on the Chancellor not to announce any further tax rises on employers, asking her to take action on business rates that support HTA members, and asking to pause and consult on the proposed changes to Agricultural and Business Property Relief, which is adding more cost and uncertainty for businesses at present.

“You may have noticed that last month’s update introduced a new Consumer Spending section, providing a broader benchmark for garden centre performance against other retail sectors. Data for August indicates that consumer card spend on household retail (including gardening) was up 1.2% from August 2024, with garden centre spend specifically only rising 0.6%. However, it is important to note that these figures exclude cash transactions and therefore differ from HTA’s overall sales reporting.”

Additional insights:

- Indoor living was the strongest performing department, up +13% year-on-year; wild bird care saw its first annual growth since March (+5%).

- BBQs and outdoor heating fell -13% year-on-year, though remain ahead of 2023 levels.

- Café and restaurant transactions rose +2%, with catering’s share of turnover reaching 16%.

Members can find the HTA’s latest water management guidance and updates at hta.org.uk/water.

HTA members can access further insights in this month’s Market Update on our website.