HTA: Warm April weather prompts +22% sales growth for UK Garden Centres

14 May 2025

UK garden centres experienced a significant surge in activity and sales in April, driven by exceptionally warm and dry spring weather, which created strong consumer demand as people returned to their gardens. The latest data from the Horticultural Trades Association (HTA) May Market Update and Q1 2025 Business Barometer reveals a robust start to the year for the environmental horticulture sector as a whole.

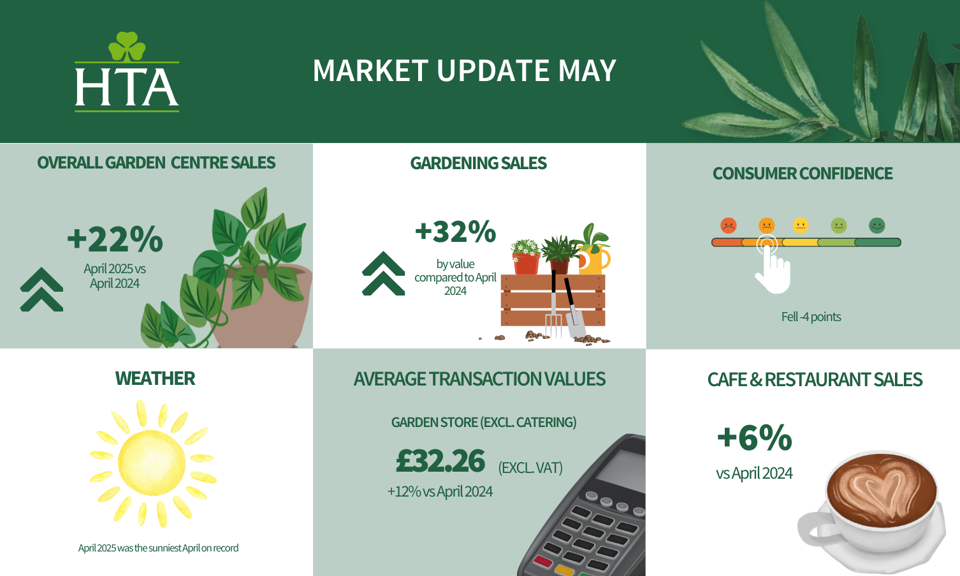

Following an already buoyant March, April delivered exceptional performance, with total garden centre sales soaring by +22% in value compared to April 2024, and up +12% on April 2023. Core gardening categories such as bedding plants, plant care products and gardening tools, as well as garden furniture and barbecues, were the primary drivers of this growth, with gardening category sales overall showing remarkable increases of +32% in value and +27% in volume year-on-year. The percentage hike is particularly large due to the exceptionally wet weather impacting sales in April 2024. This month’s uplift was also supported by higher average transaction values per visit in the garden store, which rose by +12% (reaching £32.26 excl. VAT). Year-to-date overall sales for garden centres are up +15% compared to both 2024 and 2023.

The positive trend is further supported by the HTA’s Q1 2025 Business Barometer, which covers the period up to the end of March, capturing sentiment and performance across all HTA and Association of Professional Landscapers (APL) members, including retailers, growers, landscapers, and manufacturers. Across the membership, businesses reported being an average of +3.9% ahead of their sales budgets for Q1, with 68% meeting or exceeding profit targets by the end of March. Short-term business confidence (looking ahead 3 months) has reached its highest level since summer 2021. However, this optimism comes with caution, as the strong sales performance is crucial to claw back some of the significant cost pressures members are now facing with April employment cost rises, and positive numbers need to be sustained over a more extended period to be considered a trend.

Fran Barnes, Chief Executive of the HTA, commented:

“April was an encouraging month for our sector, clearly demonstrating the impact of favourable weather on consumer behaviour and sales. Building on the momentum from March, the combination of record sunshine and calm conditions brought customers out in large numbers, directly translating into impressive performance, particularly in core gardening areas. Customers were clearly spending more per visit, with average transaction values notably higher than this time last year, indicating strong engagement and larger basket sizes. For many businesses, this positive start is providing a crucial springboard for the year ahead.

“Our Q1 Barometer across the entire industry also shows members ahead of budget on average. Short-term business confidence is currently at a nearly four-year high, reflecting the strong trading conditions experienced in the early part of the year. While this robust performance is hugely welcome and indicates underlying sector health, caution remains in the longer term. We are mindful of ongoing cost pressures, economic uncertainty, and the growing risk of drought if dry weather patterns persist, especially given the significantly lower rainfall levels seen in April compared to last year. Consumer confidence also saw a notable dip, reflecting broader cautious financial outlooks.

“This is a pivotal time for UK horticulture. As we look forward to the RHS Chelsea Flower Show, just days away, and with the sun shining, this is all set in the context of increased costs and ongoing border chaos. The HTA continue to highlight the sector's vital contribution to policymakers and the public. Our industry is not only essential for greening our environment – it’s also driving local jobs, economic growth, delivering green infrastructure and supporting the UK’s climate ambitions.”

Looking closer at the April Market Update data, top-performing gardening categories included BBQs (+70%), bedding plants (+47%), garden tools (+32%), and furniture (+27%). Other strong performers, such as hardy plants, shrubs, and trees (+26%), plant care products (+28%), and outdoor containers (+24%), highlight the demand in core gardening categories. Non-gardening categories also saw steady growth, with food and farm shop sales up by +21%, gifting by +12%, and indoor living by +8%. National rainfall was just 40.4mm in April, less than half of the April 2024 levels (111.4mm), raising concerns about summer water restrictions. Consumer confidence fell by 4 points in April to -23, with outlooks on the general economy particularly cautious at -37.

Insights from the Q1 Business Barometer reveal variations within the sector. Retailers without catering facilities significantly outperformed those with catering, showing an average sales growth of +10.6 % compared to budget, versus +7.3% for catering retailers. This is largely owing to the strong gardening sales in March 2025. Although catering continues to perform well on its own, gardening categories outpaced catering’s growth, and garden centre catering also typically has increased overhead costs, further reflecting the difference in margins.

However, APL members (landscapers) averaged slightly behind budget at -2.5% for sales and -2.9% for net profit. Long-term business confidence (looking ahead 12 months) remains cautious across the sector, reaching its lowest level since records began in Q1 2015 for landscapers. Key concerns reported by businesses included rising operating costs, uncertainty in customer demand, changes to employment law, consumer spending power on big-ticket projects, and the impact of Autumn Budget 2024 policy changes coming into force.

HTA members can access further insights in this month’s Market Update and Q1 Business Barometer on our website.